Mitigating risks on a high volatility day while making the most of it

Author: Albina Zhdanova

Last week the world was shaken by the election day in the US. Few days before, market volatility started to grow, reaching an all-time high on the day X and the few days of votes counting that followed. The article you are reading now was initially published on the TFB customer support portal before the elections to help our clients protect themselves and their traders and even make profits throughout the turbulence.

We have later decided to share this quick guide with everyone to make sure as many people as possible have the right tools and knowledge. Not all of the volatilities can be foreseen just like the one we had, but we still believe it will help brokers in the future.

Please note that the screenshots below were captured from our demo environment, so all information represented there is not real and it does not contain any confidential data.

Bridge

At TFB, we strongly believe that the bridge is the core solution in every brokerage trading environment. That is why risk management is one of the strongest sides of our Trade Processor bridging solution.

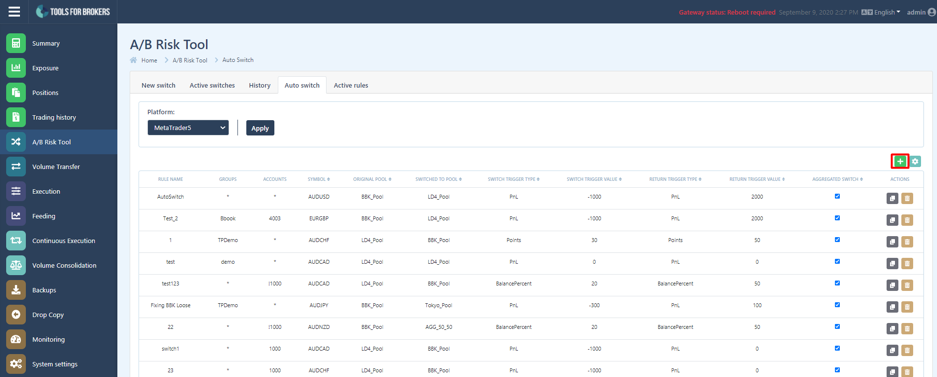

Just before Day X comes, you can temporarily switch the B-book positions to A-book and then switch them back once the market returns to normal.

Alternatively, you can pre-configure the rules and define the parameters which will trigger the switch automatically, e.g. when your clients start profiting.

Such precautions will help to avoid unnecessary risks (both financial and technical) associated with keeping the accounts on B-book. It will also guarantee the profit from the commission markup for every order.

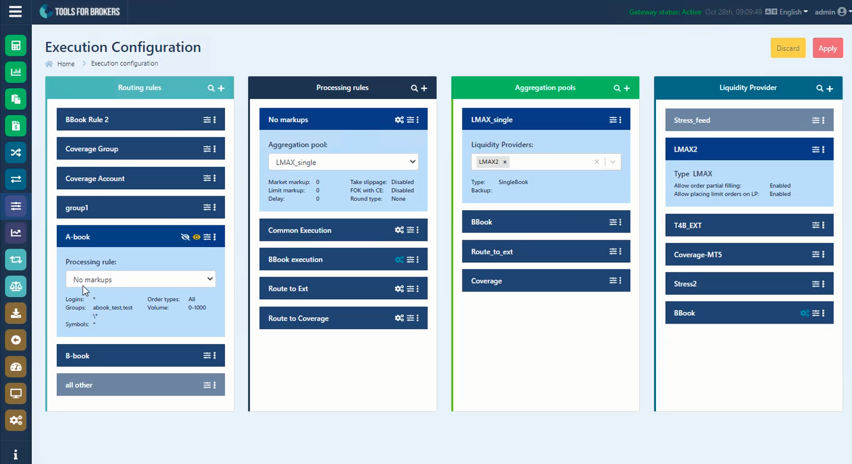

Scheduled sessions

To get the maximum from the expected trading boom and offset extra risks, we recommend configuring the processing rules with additional extended markups. This will give you even more commission per each order.

The beauty of Scheduled sessions is, you guessed it, that you plan the setup in advance. You can configure and double-check everything with the team before scheduling the sessions for specific periods. This setting will send all orders to the desired direction within the required timeframe, and afterward, it will automatically return to the normal executing algorithm.

Few extra tips for the A-book business model

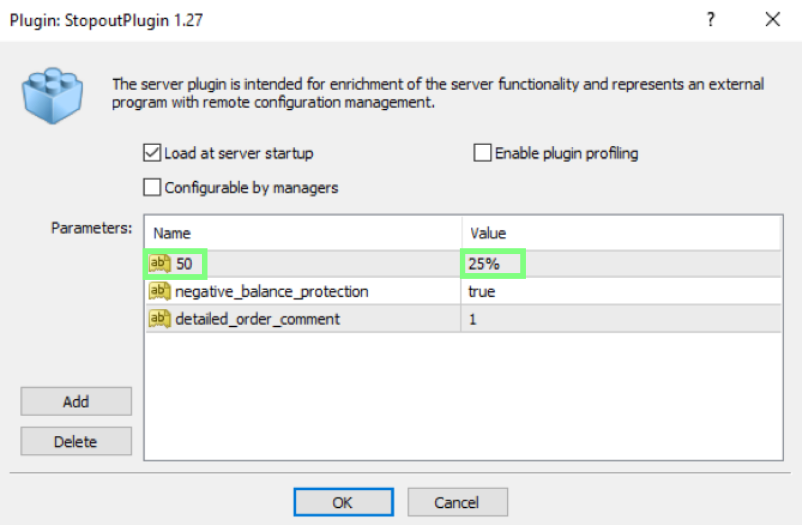

Stop out plugin is a must-have to restrict losses for a group or a certain account. The plugin lets you do it quickly. No restarts necessary.

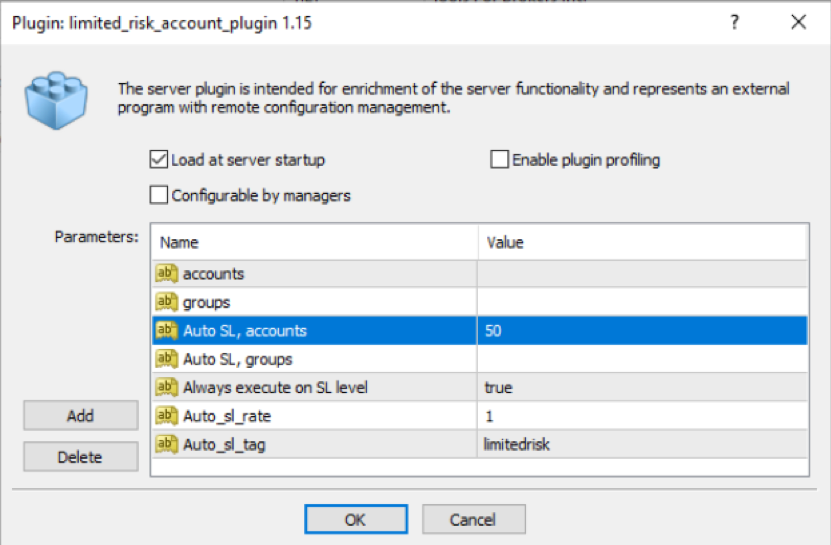

LRA plugin, with its key-function AutoSL automatically adjusts SL level not to lose more money than defined by the margin. Hence, even with the big leverage, your traders will not lose more than they have deposited.

Tips for the B-book business model

Trade Limiter plugin allows you to manage the volume of open positions. You can restrict the total volume per symbol, per group, per account, or even per one particular order.

And that is not all that we can think up together! All the tools and the Trade Processor can be arranged and configured for you in advance. You can use it at any time when high volatility is expected.

To find out more about risk management with TFB or anything else, please email us at sales@t4b.com, and one of our team will get back to you.

OF ANY PRODUCT

RIGHT NOW