The 6 types of aggregation and consolidation

Author: Alexey Kutsenko

Brokers are required by regulators to seek best deals for their clients. So when the order comes in, brokers evaluate the markets and execute the order with the best price possible. It sounds pretty straightforward and with the latest brokerage software that should be a no-brainer. In reality however it’s trickier than it might appear.

The word ‘best’ is subjective and what’s ‘best’ would differ case by case. You can have a ‘best’ offer from a single liquidity provider at the time when you are submitting a request, it can be ‘best’ split among a group of LPs, or ‘best’ can be defined by whoever has the better spread. Getting the ‘best offer’ is perfect in the short-term and this mentality is deeply integrated in all operations.

Yet what’s best in the short-term is often less appealing in the long run. What if LP1 always gives you the best bid, and LP2 — the best ask? Or say you have more than 5 LPs and positions are all over the trading platforms, that you must spend hours going through excel files to make things come together and close positions manually with huge spreads.

Proper order aggregation can make brokers’ life significantly easier.

But what is aggregation? Aggregation is a concept of managing order requests in a way that is safe and most beneficial for all parties involved in the trading process. It’s sole goal is to give you “the best offer”. TFB aggregation helps you to also achieve a long term goal — to take control of your position, automate processes and think of all possible consequences beforehand.

With TFB there are 6 ways for broker to aggregate incoming orders:

1. Single book aggregation will scan the system to see which single LP can give you the best volume weighted average price.

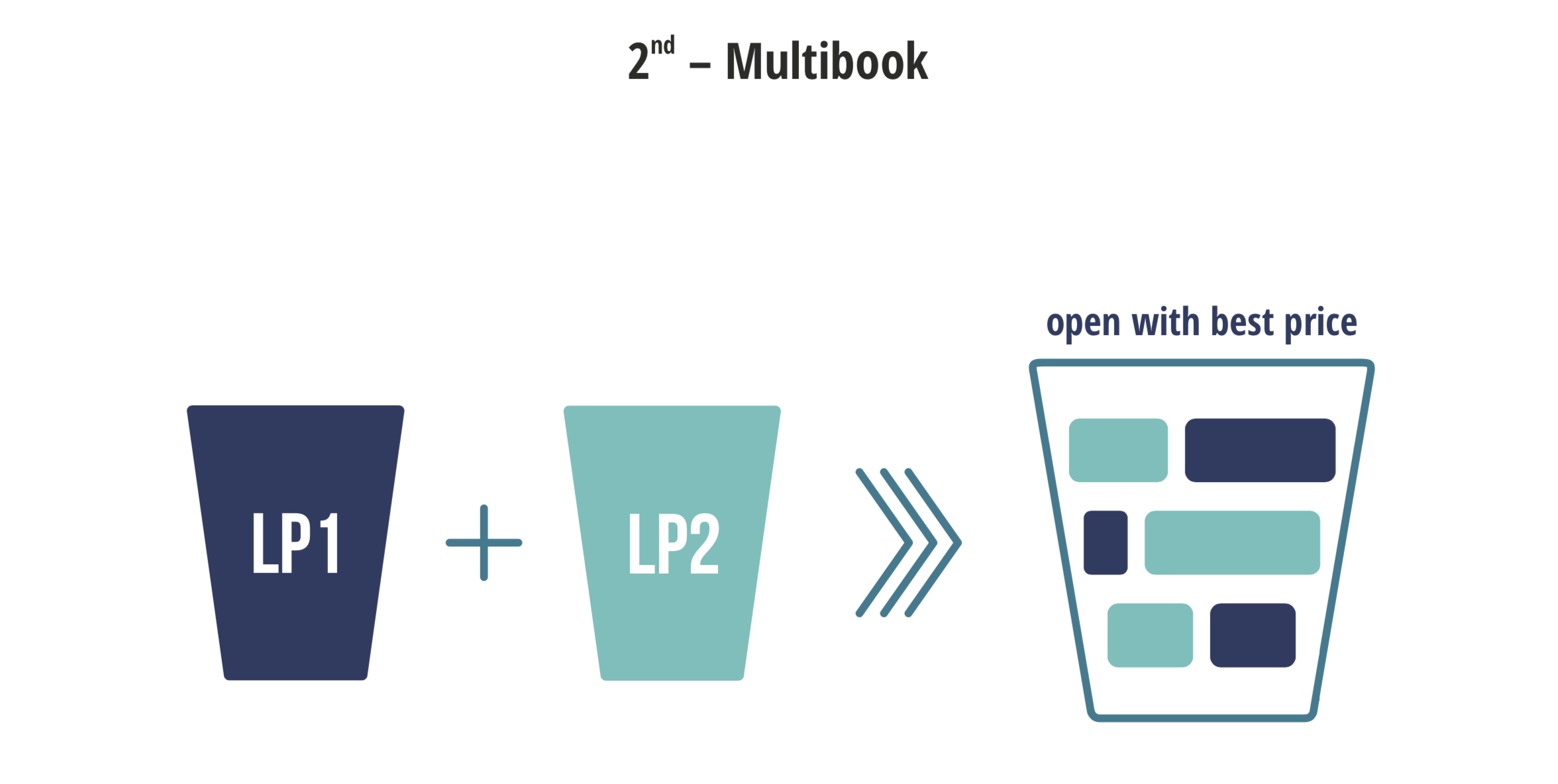

2. Multibook would execute the order across multiple LPs. Our bridging software — Trade Processor — gathers information on available pricing and volumes, analyses this information subsequently executes the orders with the best price offer that every LP can provide.

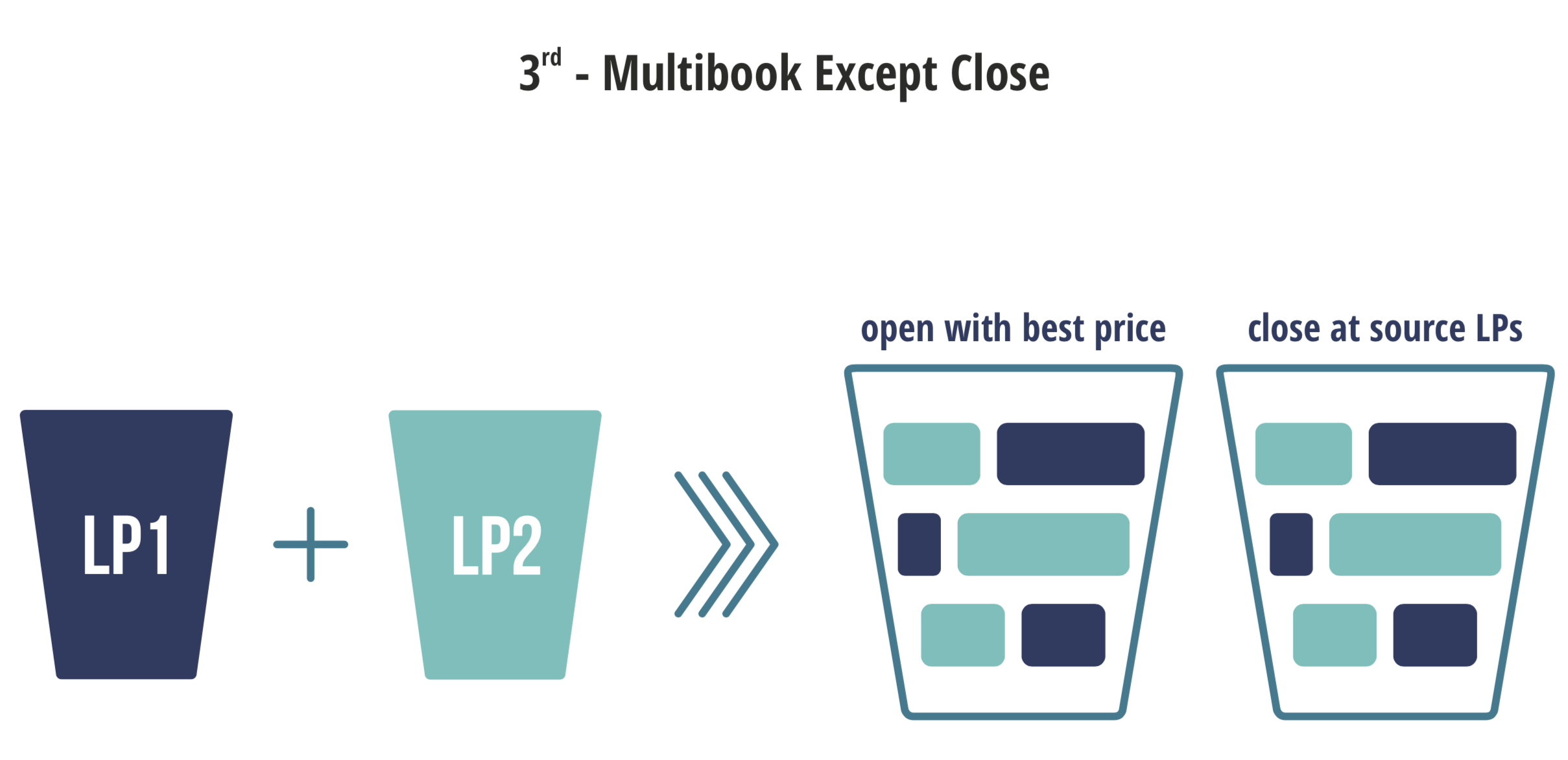

3. Multibook except close. This is something we’ve created here at TFB to solve several notorious issues that every broker is concerned about.

As it often happens, sell and buy requests tend to spread across multiple liquidity providers, forcing someone to manually consolidate it at the end of each day. Needless to say this tedious task takes hours and comes with a high risk of human error. We believe that time is too precious to waste on something that can be automated. Which is exactly what we did with our system: it tracks detailed information about orders — who is opening them, where they are opened. Subsequently we are able to execute the order with the LP where it was initially placed.

Saved time is not the only benefit of ‘Multibook except close’ mode. Opened order is a risk in itself until it has been executed. It must be tracked carefully, otherwise we might end up with added swaps and out of control spreads eating up all multibook profit.

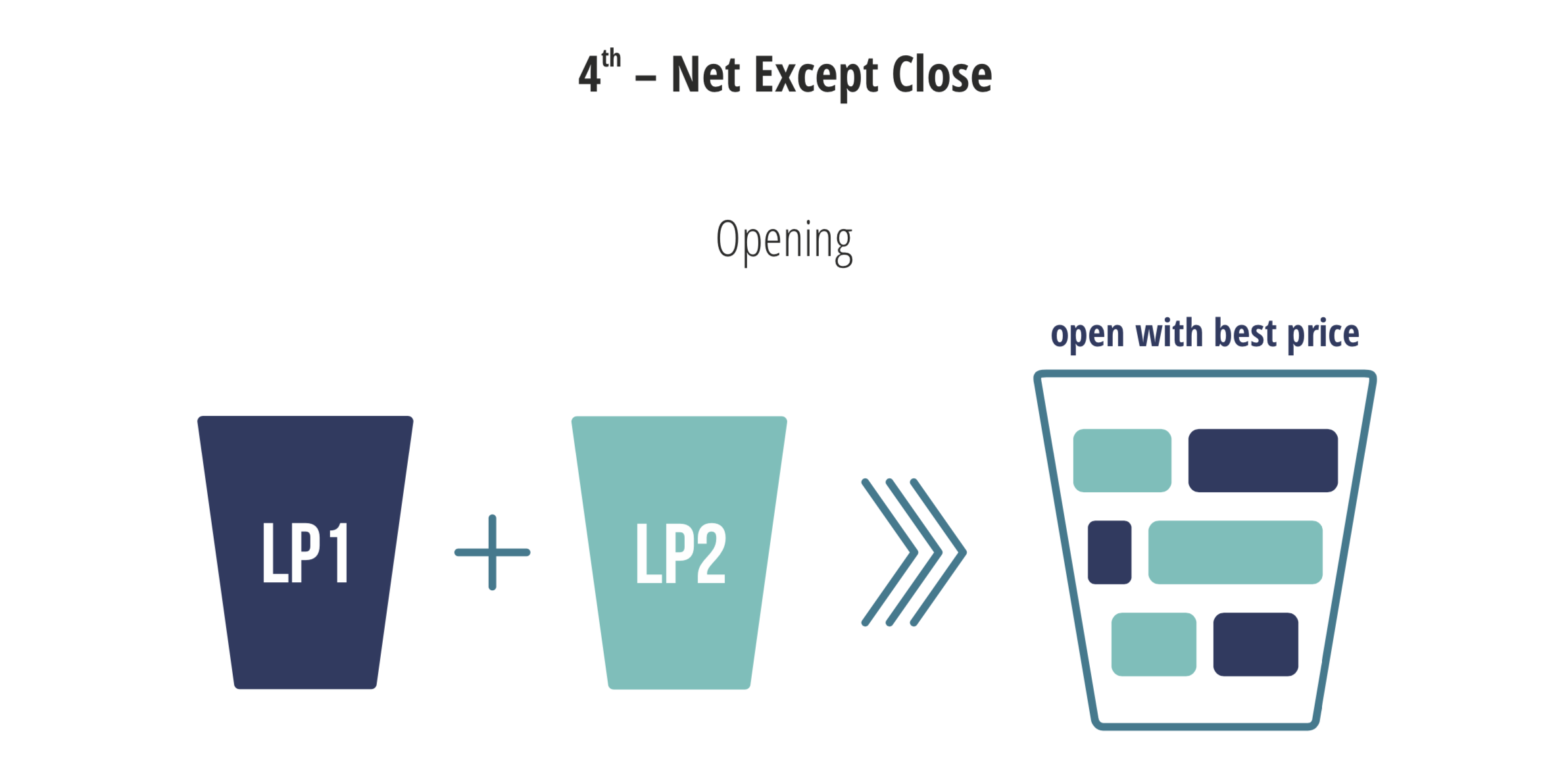

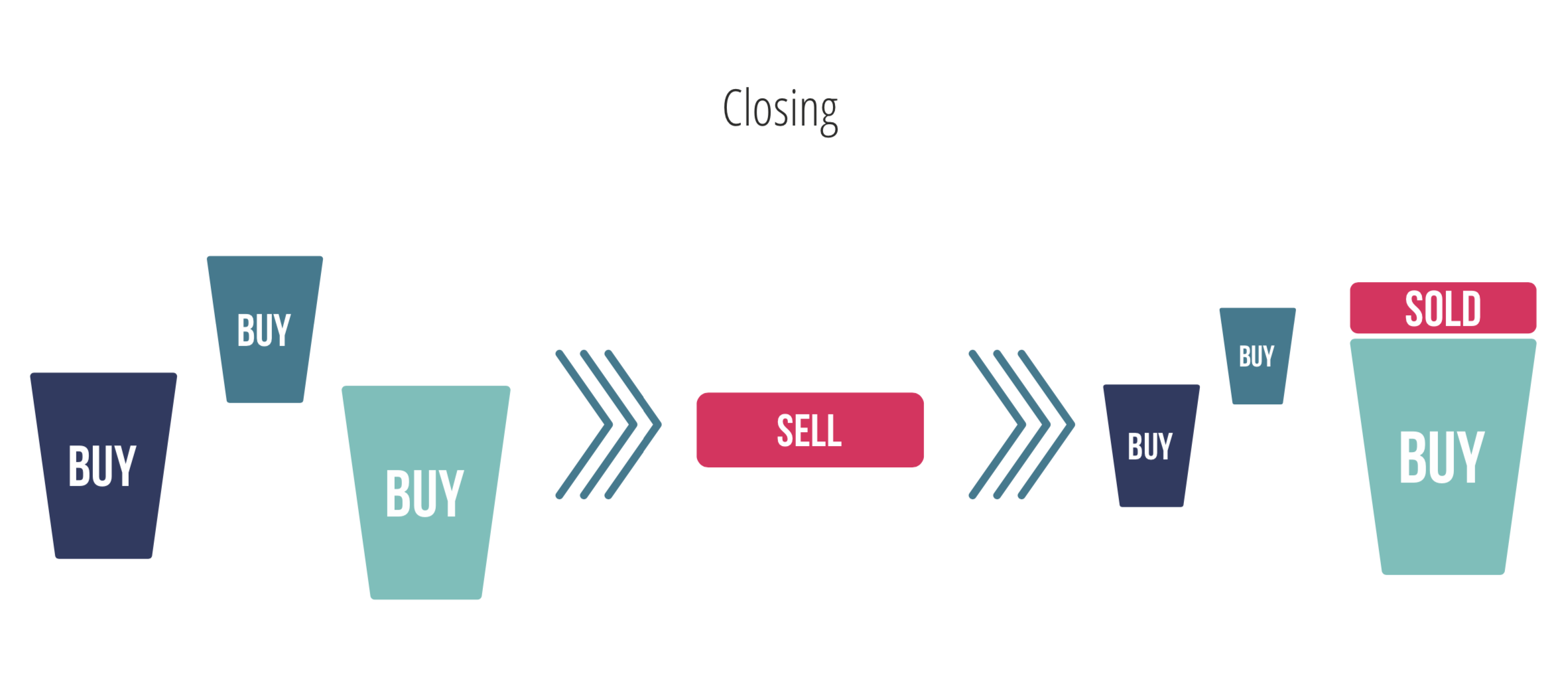

4. Net except close. The system records all actions with orders, e.g. which orders were sent to which LPs, gathers information about the total position number with liquidity providers, analyzes how many of those positions are available for sale with each of LP at what price with the end goal to close the order while simultaneously lowering net position on LP. If quantity is evenly spread across all LPs, we will split and execute the order among several providers.

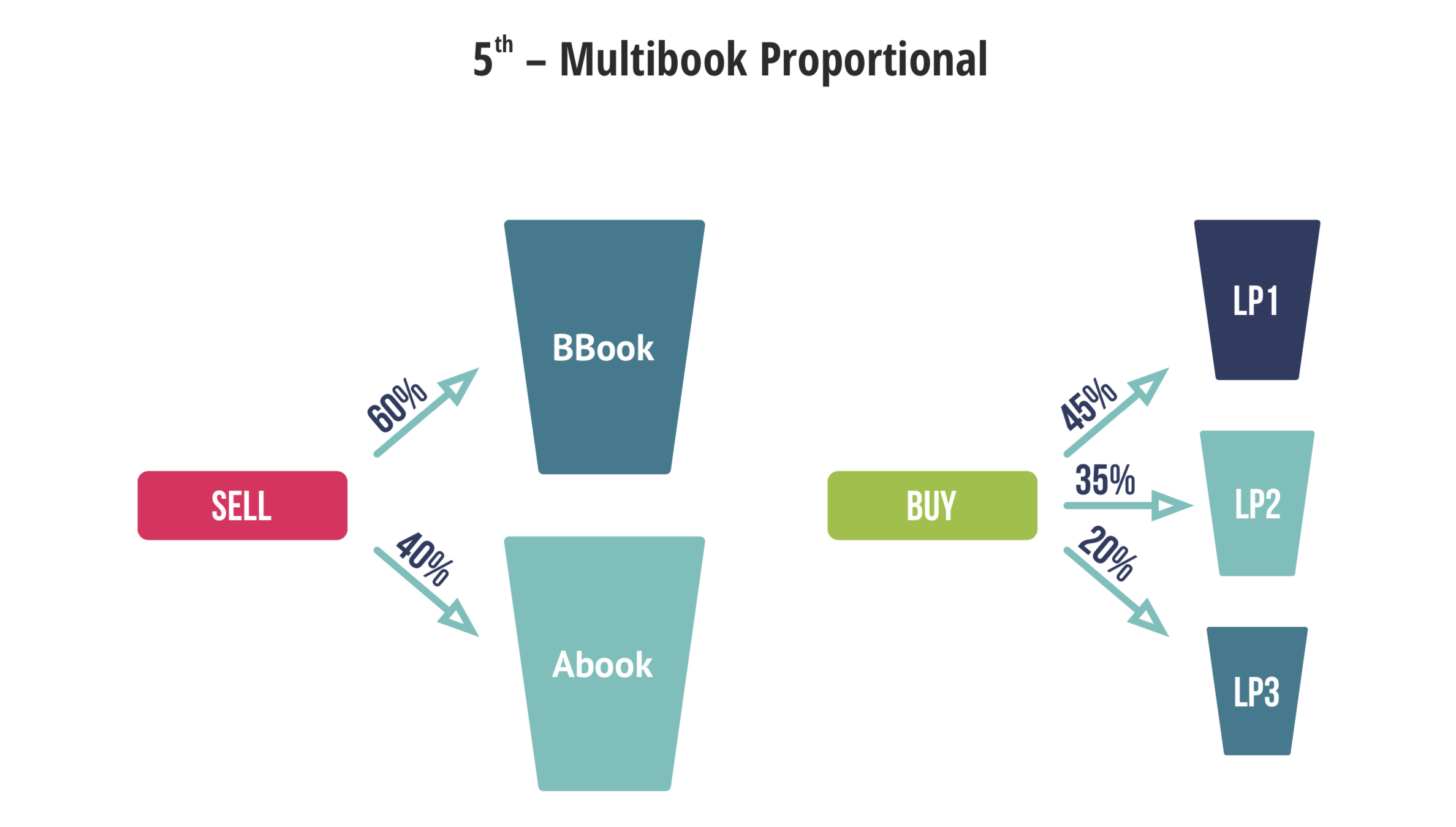

5. Multibook proportional — as you have probably guessed from it’s name, it is an execution model where the broker sets proportions when choosing the pool. This is a way to manage your risks which is often used for splitting orders between A-books and B-books.

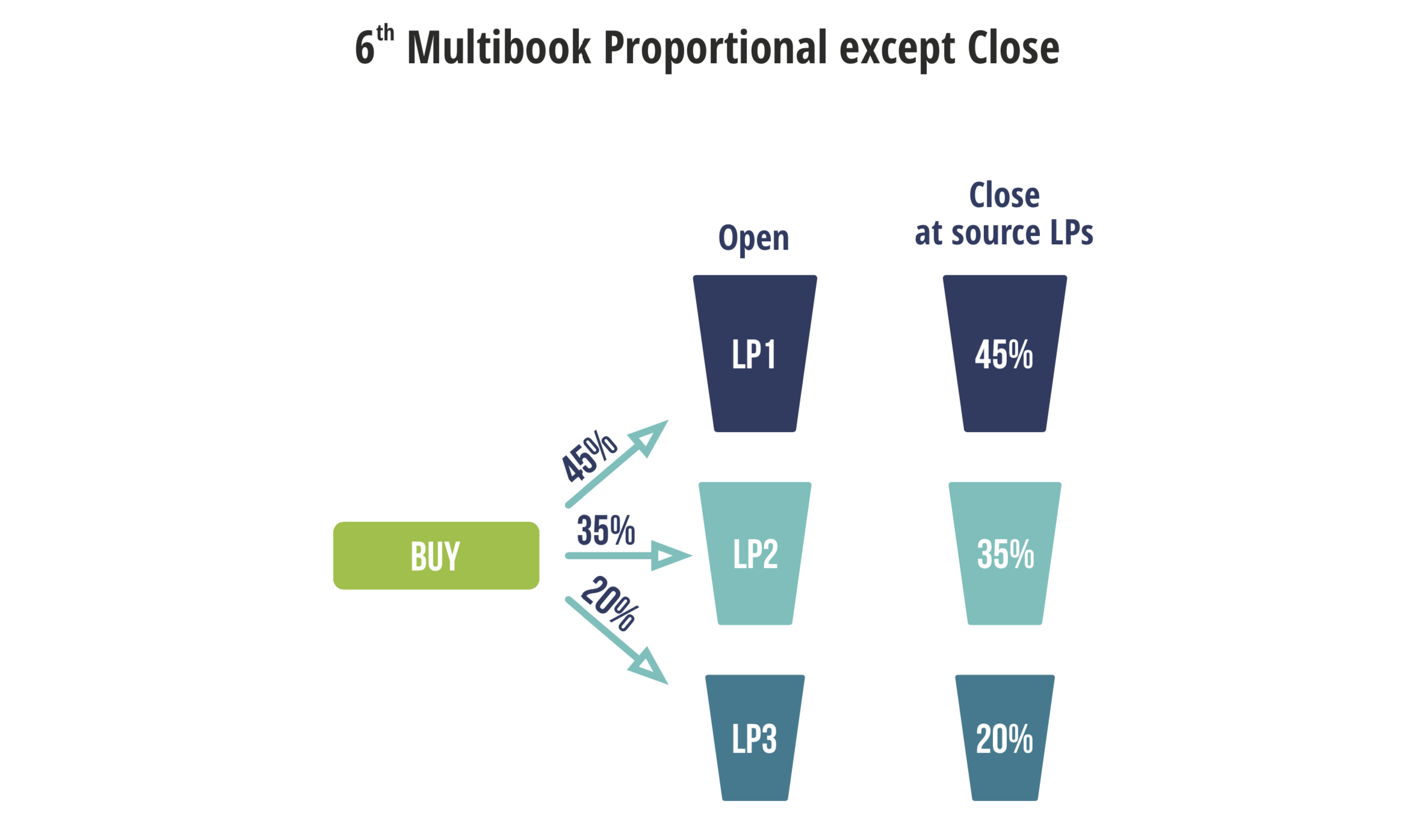

6. Multibook proportional except close. This mode would help you re-assign execution to alternative LP if your primary LP rejects your request. Our bridge will retain all movements’ history and further orders will be executed correctly.

All of the aggregation modules listed above would partner great with the Volume Consolidation feature in Trade Processor. It automatically consolidates the orders and saves brokers a ton of time. Schedule it to run at the end of the day and you will never need to worry about it again.

OF ANY PRODUCT

RIGHT NOW