Liquidity bridge for risk management: key functionality in Trade Processor

Author: Ivan Egorov

When it comes to risk management, the liquidity bridge is your primary source of protection. The Trade Processor bridge is filled with various tools for risk management, and today, we’d like to share some of them with you to help you make the most of the solution.

A/B risk tool

The A/B risk tool in Trade Processor enables clients to perform two types of switches:

- Manually switch positions from A- to B-book to temporarily hedge risks, such as in cases of high volatility or the anticipation of an important news announcement. This allows brokers to reduce their risks but can also affect profitability potential.

- Auto switch positions between books to automate risk management. A switch can be triggered once a specific PnL is reached or the price changes by X amount of points. This function can save a lot of time for dealers and maximise profits at the same time.

Smart aggregation: 6 execution modes

Besides the standard aggregation methods, the Trade Processor bridge offers extra options. For instance, the bridge remembers where certain orders were opened and is able to close them on the same liquidity providers (LPs). This minimises not only exposure but also swap costs, therefore, reducing overall risks.

One of the six aggregation modes, Net Except Close, takes exposure minimisation to a whole new level.

When your client opens a new position in the trading platform, the bridge will check if there are any positions open in the opposite direction at one of your LPs and send orders to these LPs. So instead of increasing net open positions it will minimise your exposure at the LP.

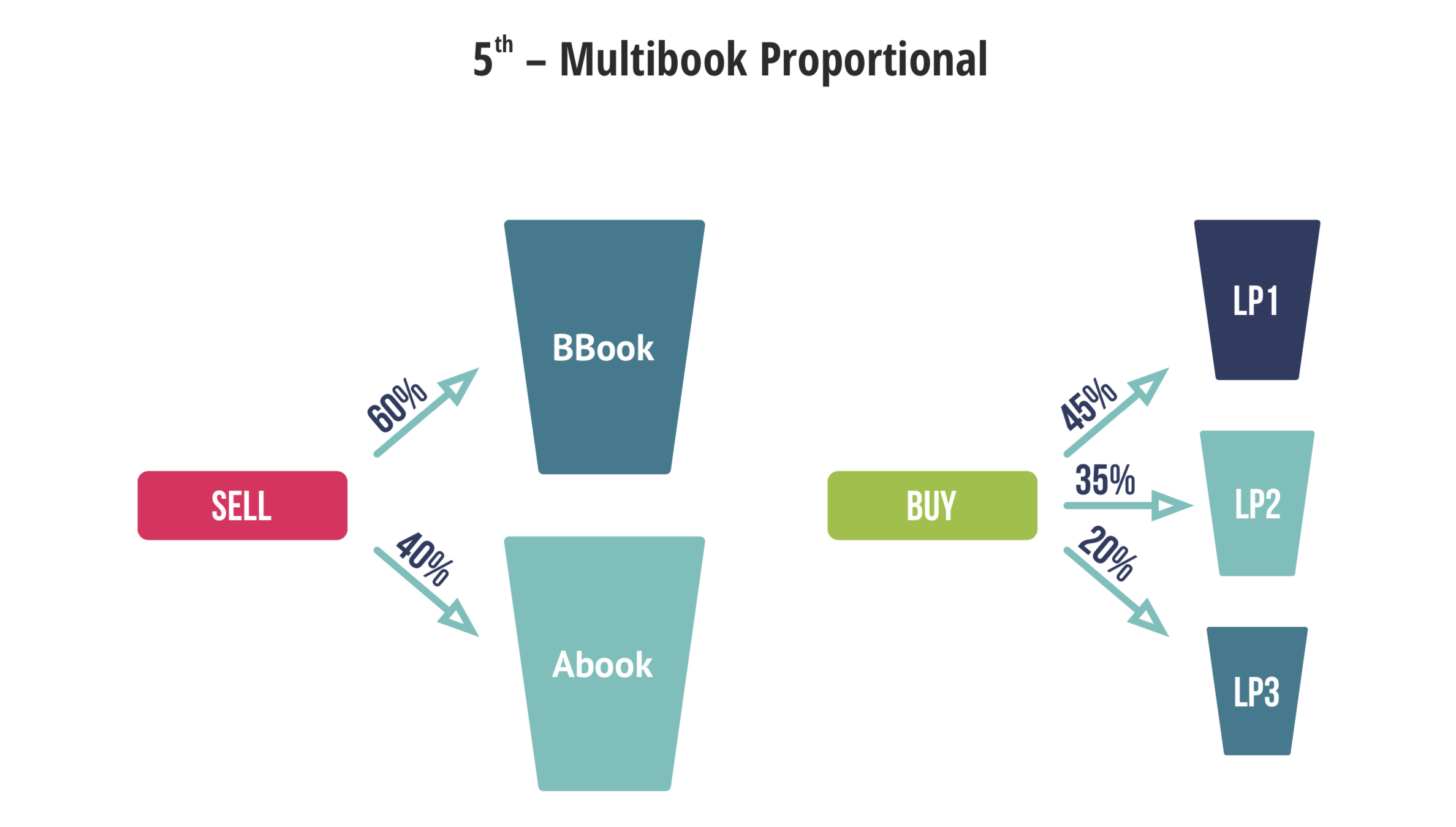

For brokers looking to partially hedge their risks, they can try Multibook Proportional and Multibook Proportional except Close aggregation modes. These two execution options allow clients to split the execution between A- and B-book proportionally to reduce their risks and potential losses.

Volume Consolidation

Sometimes, clients do not want to close the orders with the same LP where they were opened, for example, if they want to prioritise the best execution price. In those cases, clients can use Singlebook or Multibook modes for execution and utilise Volume Consolidation to avoid discrepancies between the LPs.

The Volume Consolidation tool remembers all LPs where all orders were opened and automatically consolidates them. Not only does this eliminate the risk of human error but also frees up valuable time for other tasks.

B-book hedged

The B-book hedged feature resembles the Multibook Proportional execution mode, except in this case, we set a limit to the risk that we are willing to keep on B-book for each instrument. For example, specific currencies are extremely volatile, so we set a limit of 50 lots for pairs with such currencies and anything above that will be hedged.

Execution/Feeding profiles

Trade Processor allows clients to create different profiles for specific market situations. For example, a profile can include:

- Markups

- Execution configuration

- Spreads

- Routing (A- or B-book and which LP)

- Time of execution

Brokers can specify what execution conditions should be applied during high volatility, or during the night when trading is slow and there are niche risks for trading during these hours. Profiles can also be configured to minimise risks associated with toxic trading practices.

It’s possible to create a schedule to switch profiles between one another depending on predefined conditions, such as the market situation, hours of the day, or something else.

These are the five key features that enable and enhance risk management through the liquidity bridge. Trade Processor has much more to offer, so if you’re curious to try it or would like to ask us a question, please feel free to email sales@t4b.com.

OF ANY PRODUCT

RIGHT NOW